Why Small Caps should be part of your Investment Portfolio?

Equity Fund

It’s All About Small Caps

The economy, as it revives and demand plays out, the full value chain across sectors benefits, including small cap companies. Small cap companies are those that have a market capitalization of less than the 250th stock on the stock exchange.

Along with economic data improving, corporate profitability of small cap companies can be expected to improve.

Investors looking for decent returns & having a higher risk tolerance can look to invest in small caps.

When it comes to Mutual Funds, funds that invest at least 65% of their portfolio in small cap stocks / companies can be deemed a small cap fund.

To give a perspective, there are over 4500 small cap companies listed on the stock exchange in India.

Though they have the potential to give investors good returns, to mitigate the risks of investing in small caps, it is advisable to stay invested in them for the long-term. Why do small cap funds make for a good investment choice now?

What should you watch out for before investing in them? Keep reading to know more.

Actively managed small cap funds can outperform other segments of the market, especially during phases of economic recovery or growth.

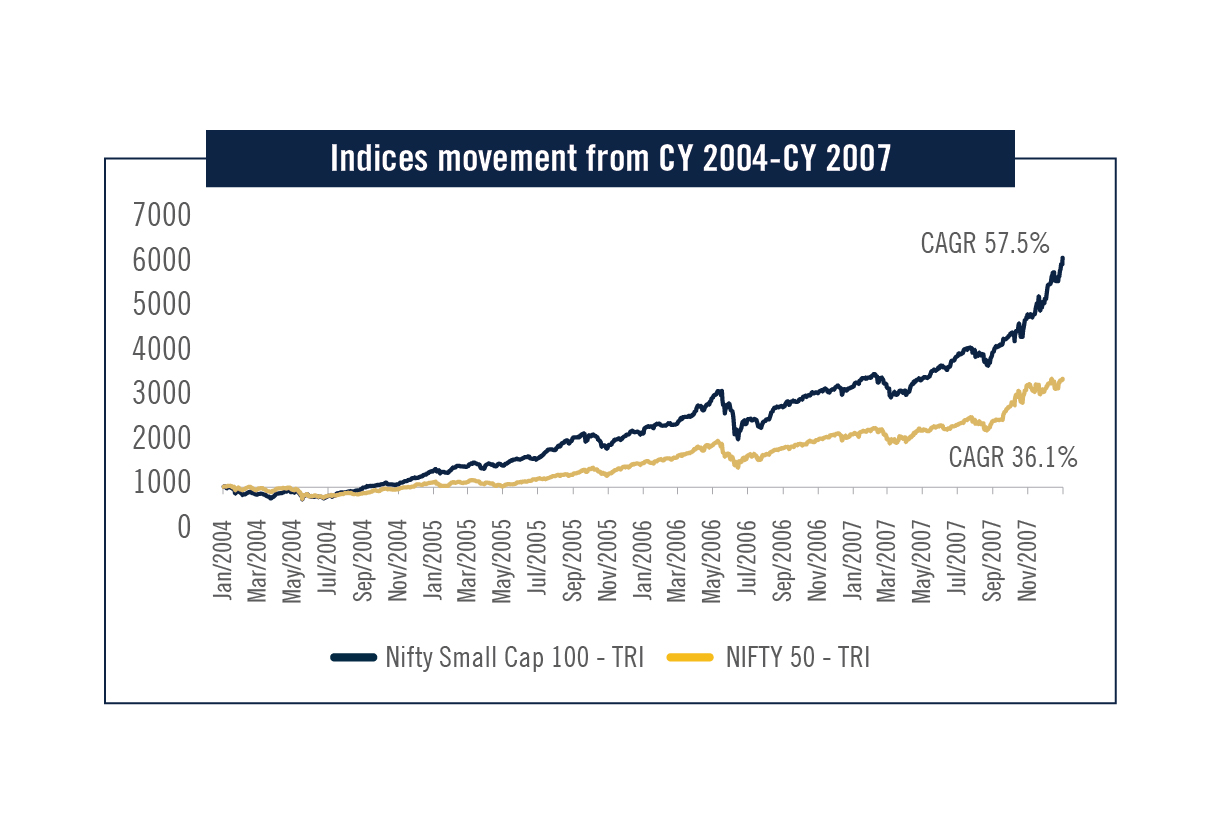

Historically too, these small cap funds have managed to outperform other segments and generated alpha over the long term,

as you can see from the graphs below:

Source: AceMF, PGIM India. Small Cap Funds Composite is an equal weighted index of regular plans of all Small Cap funds in the industry with an Aum of atleast 500 crores as of April 2021. Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments.

Source: AceMF. Above charts rebased to 1000. Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investment

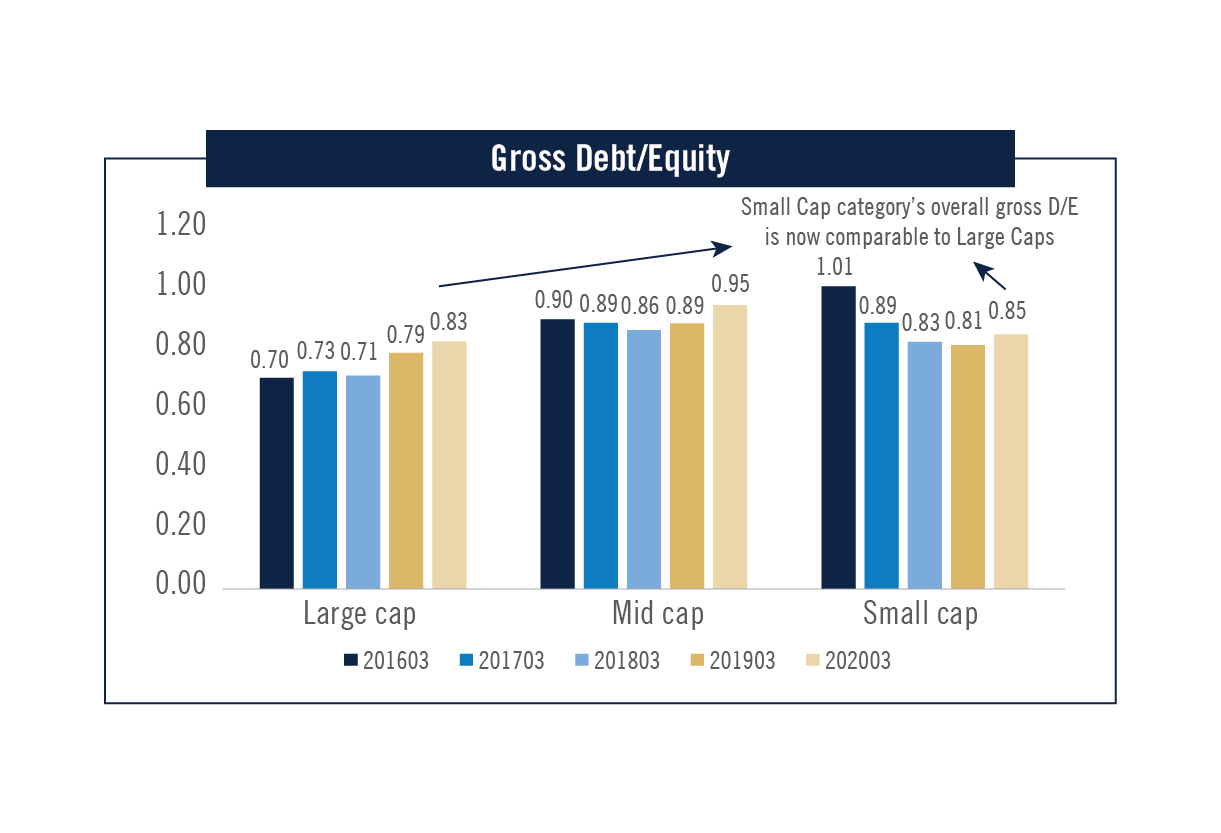

The slow pace of economic growth during COVID times, in a way, only helped consolidate small cap companies.

As a result, small caps with good management have the potential to produce good results.

Now, it may be a good time to make small caps a part of your portfolio.

The Who & What of Small Cap Funds

Here are some of the salient features of small cap funds that you as an investor should be aware of

Fund Composition

Small cap mutual funds invest at least 65% of their corpus in small companies.

The remaining 35% can be invested across the market capitalization and also debt and money market securities.

Small cap funds provide opportunity to invest in emerging businesses, companies that have the ability to scale up rapidly or companies which are established players in their respective sectors in terms of market share, profitability, etc.

Therefore, investors are exposed to PE style of investing in the early stages of these companies.

Due to their significant operating leverage, smaller companies can grow at a faster pace when compared to established companies, as shown in the chart below

Source: Spark Capital, Capitalline. Large, mid and Small Cap companies which are part of S&P BSE 500 index (ex-financials) have been considered for above analysis

Potential to create wealth

Small cap funds, especially the actively-managed ones, have managed to outperform their overall indices, as you can see from the graph below.

Actively managed funds have been more stable during volatile market conditions, when compared to the small cap index.

Also, these small cap companies have potential to become large cap or mid cap companies in the future. So, in the coming periods,

it is only natural that you make them a part of your portfolio, if you have a reasonable risk appetite.

Source: AceMF, PGIM India. Smallcap Funds Composite is an equal weighted index of regular plans of all smallcap funds in the industry with an Aum of atleast 500 crores as of April 2021. Past performance may or may not be sustained in future and should not be

used as a basis for comparison with other investments.

Diversified portfolio

One of the key features of small cap funds is the diversified portfolio they offer to their investors.

They choose to invest in new and emerging businesses, where large caps haven’t made inroads, yet.

So, they give investors exposure to different, niche and emerging sectors like chemicals, textiles, sugar, construction and more.

Though they invest in emerging businesses, small cap funds choose market leaders,

promising companies and companies that have the ability to scale up rapidly in the respective segments,

to mitigate investors' risk as much as possible.

Expansion and Growth Potential

The under-researched and under-owned nature of small caps gives them a lot of scope to expand in the future. The cut-offs for market capitalization of small caps are also continuously on the rise. The AMFI, in Dec 2020, had classified small cap companies as those with a market cap of less than Rs.8300 crores.

However, within 6 months, the market cap cut off for these small cap companies had gone up to over Rs.11000 crores. So, these companies have the potential to generate wealth for investors in the long run. The key is to stay invested in small caps throughout the full recovery or growth phase to reap benefits from them.

Factors to consider, when you invest in small cap funds

-

Aligning investors’ risk appetite with the small caps

Small caps are volatile and associated with high risk. So, only investors with a high risk appetite and an investment horizon of at least 5 years should invest in them. Staying invested in small caps for the long term is important to benefit from their potential.

-

Using SIP for small cap investments in Mutual Funds

To ensure that investments in small caps don’t get eroded due to the volatility of the stock market, investors can invest in them throughSIPs (Systematic Investment Plans). These are regular investments made at periodic intervals to benefit from market volatility and rupee cost averaging. Staggered investments through SIPs can help overcome high valuations and market volatility and help deliver alpha over the long term.

Things to remember while investing in small caps funds

- Good potential for growth and market cap expansion in the future

- Provides diversified sectors for investment

- Actively managed small cap funds have the potential to deliver alpha in your portfolio

- Good option of wealth creation for investors over the long term

- Good to invest in to fulfill long term financial goals

- Consider for their risk adjusted returns.

- Higher volatility associated with small caps stocks, comparatively

- Small cap funds should complement an existing equity-oriented portfolio

Why is this the right moment to invest in small caps?

Small-cap funds invest in businesses that have a high potential for growth. As economic activity revives and demand picks up, well managed, small cap companies may see potential upgrades in profitability and as a result decent re-rating of their business. Small Cap funds can provide an opportunity for growth by selecting such well managed small cap companies. So if you have a decent risk appetite, small-cap funds might be ideal for you. Small cap funds are suitable to achieve long term financial goals and it would be smart to include them in your portfolio. Harness the potential of promising small cap companies by investing in small cap funds through SIP or lump sum to create wealth and generate alpha over the long

term.

This article is authored by Ajit Menon, CEO, PGIM India Mutual Fund