You will never get a loan to fund your retirement: Ajit Menon, Chief Executive Officer - PGIM India Mutual Fund

Economic Times, October 20, 2020

Retirement is an area of concern globally and in India as well. We wanted to get an understanding of what people are thinking, what their attitudes and anxieties are, so that it we have a better understanding of the products they need.

READ MORE

Overseas markets: Should you invest directly or through mutual funds? -Srinivas Rao Ravuri, Chief Investment Officer – Equity, PGIM India Mutual Fund

Economic Times, October 13, 2020

We are living in an increasingly globalised world. As an Indian consumer, we have benefitted from the availability of a variety of high-quality goods and services that are produced outside India -- be it mobile phones or luxury cars. Globally, there is a lot of innovation taking place that is impacting our daily lives.

READ MORE

PGIM looks for domestic AMC acquisition to grow faster: Ajit Menon, Chief Executive Officer - PGIM India Mutual Fund

Economic Times, September 19, 2020

Prudential Global Investment Managers (PGIM), which has set a target of being among the top 10 fund houses over the next five years in the country, is looking for an acquisition to drive its mutual fund business here.

READ MORE

July-Sep period will continue to show weak earnings - Ajit Menon, Chief Executive Officer - PGIM India Mutual Fund

Economic Times, July 14, 2020

The July-September period will continue to show weak earnings. It will be better in the next quarter since the festival season and a good monsoon will influence it. The last quarter of the year will probably be much better as further clarity emerges.

READ MORE

The risk of another market sell-off definitely exists - Srinivas Rao Ravuri, Chief Investment Officer – Equity, PGIM India Mutual Fund

ET Wealth, June 22, 2020

We are very cautious about the economic outlook. We believe recovery will be tough and will take time. The first priority for companies today is to survive.

READ MORE

Rural consumption will be the silver lining to the dark clouds - Ajit Menon, Chief Executive Officer - PGIM India Mutual Fund

ET Markets, June 19, 2020

Our job will be to continuously look at good companies across segments.

READ MORE

Is Your Portfolio Ready For The Future? - Ajit Menon, Chief Executive Officer - PGIM India Mutual Fund

Outlook Money, April 28, 2020

We are living in an increasingly globalised world. As an Indian consumer, we have benefitted from access to a variety of high-quality goods and services that are produced outside India but not produced domestically. However, integration into a global economy also brings in a unique challenge to investments.

READ MORE

Virus crisis an opportunity for Indian firms to become global majors: Srinivas Rao Ravuri, Chief Investment Officer – Equity, PGIM India Mutual Fund

ET Markets, April 28, 2020

The falling crude prices is a big positive for the Indian economy as we import almost 85 per cent of our requirements. Drop in prices also help conserve our foreign reserves and more importantly provide additional revenues to the government, which can be spent to revive the economy.

READ MORE

Pharma, chemicals and utilities safe sectoral bets in these times: Srinivas Rao Ravuri, Chief Investment Officer – Equity, PGIM India Mutual Fund

ET Markets, April 27, 2020

What we needed was a confidence booster. This definitely plays a big role in doing that. Also, one needs to understand that what we are going through is an issue with a specific category within a mutual fund but there is a bit of panic in the industry or among retail investors on what is happening in the mutual fund industry.

READ MORE

Keeping The Faith—Investments During A Pandemic: Ajit Menon, Chief Executive Officer - PGIM India Mutual Fund

Outlook Money, April 11,2020

Don’t throw the baby out with the bath water! The said proverb best explains what to guard against as investors. Investing has always been and will always remain first about buying into good businesses. While fear is predominant at this time and the daily dose of bad news exaggerates negativity, it is important to step back and look at this in the context we are in.

READ MORE

Value investors going through a rough patch but value investing is not dead: Srinivas Rao Ravuri, Chief Investment Officer – Equity, PGIM India Mutual Fund

ET Markets, March 13, 2020

Assuming a time frame for goal and personal risk appetite, an investor should first focus on asset allocation, preferably taking support of a financial advisor and plan how much to invest in different asset classes

READ MORE

D-Street to deliver 10-12% CAGR growth over 5-10 yrs; near-term challenging: Srinivas Rao Ravuri, Chief Investment Officer – Equity, PGIM India Mutual Fund

MoneyControl, February 24, 2020

Weaker crude oil prices and continuous inflows from both domestic and foreign investors are providing good support to equity markets.

READ MORE

Do you have enough insurance? Use this thumb rule to find out: Ajit Menon, Chief Executive Officer - PGIM India Mutual Fund

ET Wealth, February 15, 2020

The most important question to address while creating a financial plan is that if something untoward was to happen to an earning member of the family what happens to the goals, aspirations of the family and who takes care of the liabilities like home loan?

READ MORE

8 financial lessons learnt over the decades: Ajit Menon, Chief Executive Officer - PGIM India Mutual Fund

ET Wealth, January 24, 2020

As we embark on yet another decade, I was reminded of the past; the decades that have passed since I started my career.I was able to reflect on how my financial journey has evolved over the years, and my learning from it.

READ MORE

Buy multi-cap funds; overweight on pharma, chemicals & utilities: Srinivas Rao Ravuri, Chief Investment Officer – Equity, PGIM India Mutual Fund

MoneyControl, December 17, 2019

Markets are implying that things will get better from here. From a low base in 2019, marginal improvement in demand and lower credit costs and tax rates would result in decent earnings growth for 2020..

READ MORE

Exempt switches between schemes from capital gains tax: Ajit Menon, Chief Executive Officer - PGIM India Mutual Fund

ET Wealth, December 16, 2019

Retirement is a long-term goal and investors often have to make changes in their asset mix or choice of investment during the span of the investment..

READ MORE

PGIM India MF to launch balanced advantage, retirement funds next year: Ajit Menon, Chief Executive Officer - PGIM India Mutual Fund

The Hindu Business Line, November 23, 2019

PGIM India Mutual Fund, the country’s largest fund house, plans to launch a balanced advantage fund and a retirement fund in India in the first quarter..

READ MORE

Short-duration funds give better yields than FDs: Kumaresh Ramakrishnan, CIO-Fixed Income - PGIM India Mutual Fund

Money Control, October 15, 2019

Ideally you should be investing in these products with a three-year time frame to benefit from the tax treatment for long-term capital gains.

READ MORE

I don't think optimism has gone out of mutual funds says Rajesh Iyer, CEO

Publication: Hindu Business Line. Date: 14th July 2018

Rajesh Iyer, CEO, DHFL Pramerica MF shares his industry perspectives in an exclusive interaction with HBL..... READ MORE

"Don't rule out small- and mid-caps altogther" says Rajesh Iyer, CEO

Publication: Business Standard Date: June 19, 2018

Rajesh Iyer recently gave an interview to Business Standard which appeared in today's newspaper captioned "Don't rule out small- and mid-caps altogther"..... READ MORE

.jpg?sfvrsn=2)

Strike a balance between small and mid caps says EA Sundaram, CIO-Equity

Publication: Hindu Business Line, June 18, 2018

EA Sundaram recently wrote an article for Hindu Business Line which was published yesterday captioned "Strike a balance between small and mid caps"..... READ MORE

Need to take an unconventional route when it comes to managing products: DHFL Pramerica’s Rajesh Iyer

Publication: Mint Date: April 03, 2018

Rajesh Iyer has been part of the financial services industry for two decades. Of this he has spent slightly over a decade managing the investment advisory ......

READ MORE

A wider debt market will grow credit funds: Kumaresh Ramakrishnan, CIO Fixed Income

Publication: Mint Date: March 12, 2018

Not withstanding the concerns about high valuations and elevated oil prices, the Indian stock market is likely to benefit from recovery in earnings ......

READ MORE

Fund flows into India to be healthy despite LTCG Tax: John Praveen, CIS, Pramerica International Investments

Publication: Economic Times Date: March 05, 2018

Not withstanding the concerns about high valuations and elevated oil prices, the Indian stock market is likely to benefit from recovery in earnings ......

READ MORE

Market rally transitioning from being liquidity-driven to earnings-driven: John Praveen, MD& CIS, Pramerica International Investments

Publication: Business Standard Date: August 21, 2017

John Praveen, managing director and chief investment strategist at Pramerica International Investments, tells Vishal Chhabria the recent stock market correction is due to high valuations, strong year-to-date market gains, geopolitical tension ...

READ MORE

Great insights from a market veteran: interview with EA Sundaram

Publication: wealthforumezine.net Date: Dec 5, 2017

The economy is in a constant flux and that is reflected in the stock market. During periods of volatility and fluctuations, investors can panic and wonder if they have invested wisely. Sundaram outlines...

READ MORE

Big Opportunity Ahead: Suresh Soni

Publication: Mutual Fund Insight Magazine Date: November 2017

Over the last year, the industry has seen strong growth following demonitisation and reducing appetite for physical assets....

READ MORE

Allocate a large share to short-term debt funds: Kumaresh Ramakrishnan

Publication: economictimes.com, Date: Nov 16, 2017

The bond yields crossed the seven per cent mark this week due to domestic and international factors. ET.com

Mutual Funds spoke to Kumaresh Ramakrishnan , CIO-Fixed Income, DHFL Pramerica Mutual Fund, to

understand the current situation in the debt markets and how it is going to impact the debt mutual fund investors....

READ MORE

Forget gold, look at fixed income as an asset class to hedge your portfolio: Suresh Soni

Publication: Moneycontrol.com; Date: September 2017

Suresh Soni, Chief Executive Officer of DHFL Pramerica Asset Managers Private Ltd, said equities remain an attractive asset class for the long term and a systematic investment in equities would deliver attractive returns for investors....

READ MORE

A quantum leap: India’s capital markets need regulatory streamlining, institutional development, and investor education: David Hunt President & CEO PGIM, the asset management business of Pramerica Financial and Arvind Rajan is Head, Global & Macro, PGIM Fixed Income

Publication: Business India; Date: June 2017

India can benefit by deepening its financial markets, especially the corporate and securitised bond market, to meet its massive infrastructure funding needs and unlock growth potential....

A quantum leap: India's capital market requires a further boost to it already healthy growth: David Hunt President & CEO PGIM, the asset management business of Pramerica Financial and Arvind Rajan is Head, Global & Macro, PGIM Fixed Income

Publication: Business India; Date: May 2017

India’s new administration has made remarkable progress in putting the country back on a strong growth path...

Indian Market is not a bubble: Glen Baptist, CEO & CIO, Pramerica International Investments

Publication: Business Standard; Date: May 12, 2017

Glen Baptist, chief executive officer and chief investment officer of US-based Pramerica International Investments who manages $79 billion of assets, says despite...

READ MORE

This should be a benign year for FII flows into India: Akash Singhania

Publication: Business Standard ; Date: March 3, 2017

The market's direction in the near term would be driven by global factors, rather than local ones, says Akash Singhania, Deputy CIO-Equties, DHFL Pramerica Asset Managers Pvt. Ltd......

READ MORE

With interest rates falling, head for debt funds

Publication: Morningstar India Markets Observer 2017

This is the right time to explore the scenario of falling interest rates and take a prudent look at alternative investment avenues to bank fixed deposits. READ MORE

Consumption, Employment, Growth: Three-point agenda for Budget 2017

Publication: Business Standard Date: January 27, 2017

It is an opportune time to boost consumption demand, which thinned post demonetisation says Suresh Soni, CEO, DHFL Pramerica Asset Managers. READ MORE

We'd want to put more money to work in India: David Hunt, CEO, PGIM

Publication: Economic Times ; Date: January 12, 2017

The year 2017 will be a good time to put money to work in India and emerging markets, said David Hunt , CEO, PGIM, the global investment management business of Pramerica Financial that oversees over $1 trillion in assets. Newark-based Hunt, who was in Mumbai recently, said he does not see demonetisation altering the country's

fundamentals. READ MORE

Don't expect fireworks in the next three months

Publication: ET Wealth ; Date: December 19, 2016

Through earnings growth will be slow, certain segments like consumer staples will bounce back fairly quickly post-demonetisation, Suresh Soni tells Sanket Dhanorkar. READ MORE

DHFL Pramerica Mutual Fund plans to double its branch network in two years : Suresh Soni, CEO, DHFL Pramerica Asset Managers

Publication: Hindu Business Line ; Date: December 8, 2016

DHFL Pramerica Mutual Fund, which had assets under management of about Rs. 25,000 crore as on September 30, plans to double its branch network from the current 23 locations in the next two years and mostly beyond the top 10 cities. READ MORE

We will wait for stabilisation before investing in EMs including India: John Praveen, Pramerica International Investments Advisers

Publication: The Economic Times ; Date: November 23, 2016

In a chat with ET Now, John Praveen, Chief Investment Strategist, Pramerica, says once there is a little bit of stabilisation in emerging market space, this particular correction would be seen as a buying opportunity. READ MORE

Reversal of FII flows due to global risk-off is a worry - Akash Singhania, Deputy-CIO, Equities, DHFL Pramerica MF

Publication: Business Standard ; Date: November 7, 2016

The US Election outcome will cause short-term volatility but investors will move their focus to a Federal Reserve rate hike and possible stimulus says Akash Singhania, Deputy-CIO, Equities, DHFL Pramerica MF READ MORE

DHFL Pramerica MF sees corporate earnings growing 14-15% in 3-5 years: Akash Singhania

Moneycontrol.com ; Date: November 4, 2016

Corporate earnings are expected to touch 14-15 percent in the next 3-5 years, while for the next 2 years earnings growth will remain in the band of 10-12 percent, says Akash Singhania, Deputy CIO-Equities at DHFL Pramerica Mutual Fund. READ MORE

Indian markets are favourably placed - John Praveen, Chief Investment Strategist, Pramerica International Investments

Publication: Mint ; Date: November 1, 2016

Indian Markets are placed favourably, as there is a lot to choose from, says John Praveen, Pramerica International Investments READ MORE

We are committed to the retail market in India - Suresh Soni, CEO, DHFL Pramerica Asset Managers

Publication: Outlook Money ; Date: November 2016

We have a retail DNA and would like to offer products that market needs, says Suresh Soni, CEO, DHFL Pramerica Asset Managers READ MORE

Salvation lies within – the mantra for successful investing: EA Sundaram

Publication: www.moneycontrol.com Date: October 25, 2016

It makes eminent sense for any investor to focus on having a “good” investment program, rather than “the best” investment program, says EA Sundaram, CIO-Equities, DHFL Pramerica MF READ MORE

Investors should build a well thought out investment programme: EA Sundaram

Publication: ET Wealth ; Date: October 24, 2016

Historically, the long-term returns from the stock market have been in the range 16-17% and earnings growth has also been similar. This is no coincidence. It has been established that there is a definite long-term co-relation between earnings growth and returns says EA Sundaram, CIO-Equities, DHFL Pramerica MF READ MORE

Large Caps can indeed turn out to be multi-baggers over a period of time: Akash Singhania

Publication: Dalal Street Investment Journal ; Date: October 17-30, 2016

Typically, large-cap companies are market leaders and have strong fundamentals and business models to weather adverse cycles. They inhibit a greater extent of compounding led gains which make them multi-baggers over a period of time says Akash Singhania, Deputy CIO-Equities, DHFL Pramerica MF

READ MORE

Bond markets wont be hit even if PSBs start aggressive lending: Kumaresh Ramakrishnan

Publication: Financial Express ; Date: October 20, 2016

With public sector banks (PSBs) consolidating their balance sheets, corporates are

increasingly shifting to the debt market to benefit from lower rates, Kumaresh Ramakrishanan,

Head - Fixed Income, DHFL Pramerica Mutual Fund tells .. READ MORE

RBI may cut rates by 75-100 bps says Suresh Soni, CEO, DHFL Pramerica Asset Managers

Publication: Mutual Fund Insight ; Date: November 2016

RBIs stance of easing liquidity should augur well for bond markets.Investors should

do well to consider accrual as well as short-medium term funds says Suresh Soni,

CEO, DHFL Pramerica Asset Managers. READ MORE

Large-caps, big attraction: Akash Singhania

Publication: Hindu Business Line ; Date: October 2

Asset allocation among different instruments has always been one of the prime drivers

of portfolio returns for any investor. Even within specific asset classes.... READ MORE

The rally in emerging markets not over yet: John Praveen

Publication: Economic Times ; Date: October 3

For Pramerica International Investments, which has assets under management worth

$75 billion, India is among its top overweight markets in Asia and.... READ MORE

High Liquidity,stimulus driving market: John Praveen

Publication: Business Standard ; Date: September 22

Liquidity conditions will continue to remain benign globally if the US Federal Reserve

raises rates in the near term,says John Praveen,Chief Investment Strategist,Pramerica

International Investments.... READ MORE

I do not see the need to reduce expense ratio in debt fund: Kumaresh Ramakrishnan

Publication: CafeMutual.com ; Date: September 2, 2016

Kumaresh Ramakrishanan, Head - Fixed Income, DHFL Pramerica Mutual Fund feels that

the expense ratio in debt funds is competitive and fixed income products will generate

good returns in the next financial year.... READ MORE

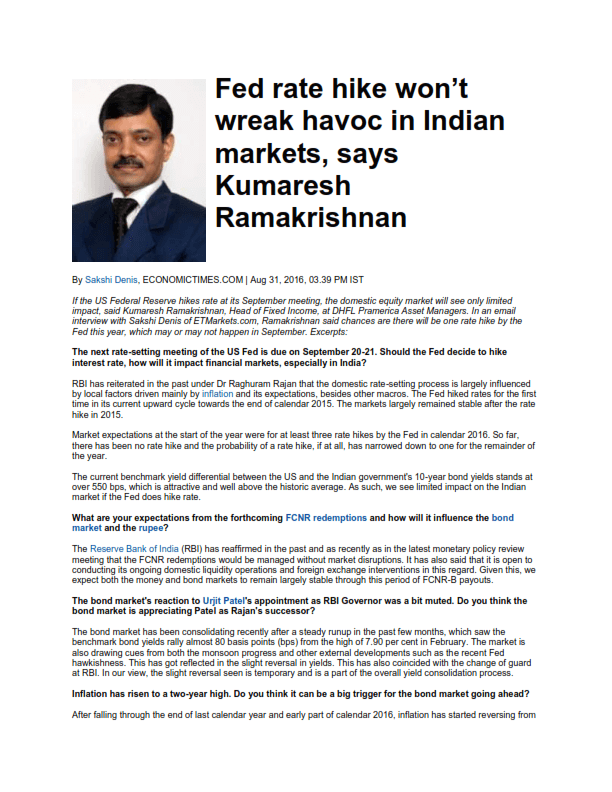

Fed rate hike won't wreak havoc in Indian markets: Kumaresh Ramakrishnan

Publication: ET ; Date: August 31,

If the US Federal Reserve hikes rate at its September meeting, the domestic equity

market will see only limited impact, said Kumaresh Ramakrishnan, Head of Fixed Income,

at DHFL Pramerica Asset Managers.... READ MORE

If adviser focuses on sale, his advice will be no good: Glen Baptist

Publication: ET Wealth; Date: August 8, 2016

Glen Baptist speaks on how financial disclosure standards need to improve in India,

why direct mutual funds won't suit everyone and whether robo advisers can replace

humans .... READ MORE

Monetary stimulus is what's driving markets: Glen Baptist

Publication: Economic Times; Date: August 26, 2016

Continuous stimulus and negative interest rates will have an impact on the financial

sector which will not be good for growth, Glen Baptist, CEO, Pramerica International

Investments, said in an interview with ET's.....

Next-gen would be 3x richer, shows market trend: EA Sundaram

Publication: DNA Newspaper; Date: August 23, 2016

The stock market index with the longest track record in India is the BSE Sensex.

The index has returned about 16.14% per annum since 1979. Including dividends,....

READ MORE

Bought a stock that isn't moving? Hold if your thesis holds: EA Sundaram

Publication: moneycontrol.com; Date: August 24, 2016

In the process, several investors ignore the business fundamentals of the company

behind the stock, and focus on “what is going to move up the fastest”

This chain of events, unfortunately, has happened too many times.... READ MORE

One Should expect the markets to remain volatile: Glen Baptist

Publication: Business Standard ; Date: July 25, 2016

US-based Pramerica International Investments had Rs 22,900 crore of assets under

management (AUM) in India, as of last month. Despite economists lowering the global

growth forecast for FY17, Glen Baptist, its chief executive .....READ MORE

Expect earnings growth of 12-14% in medium to long term

Publication: Hindu Business Line ; Date: June 27, 2016

Akash Singhania, Head - Equities at DHFL Pramerica Asset Managers, shares his views on the economy and markets.READ MORE

Pramerica Investments has a big appetite for India

Publication: Hindu Business Line ; Date: July 22, 2016

PGIM, the global investment management business of US-based Prudential Financial

Inc (known as Pramerica in India), is open to doing more acquisitions to grow its

asset management business in India, Glenwyn P Baptist, Chief Executive Officer .....READ MORE

Are you fit to invest in stocks?

Publication: ET Wealth ; Date: July 18, 2016

The advent of 24/7 commentary on TV channels and the popularity of social media

forums have spawned a breed of people who think that the real test of an investor

(or a fund manager) is his ability to predict exactly how the stock market, or .....READ MORE

Scaling mountains

Publication: Mutual Fund Insight ; Date: July 2016

Equity-fund managers in India often get superstar status. But if you’re a

debt investor, you would surely agree that debt-fund managers don’t have it

easy. India’s fixed income markets have been anything but .....

How To Safeguard Your Mutual Fund Portfolio From 2008-like Scenarios

Publication: BusinessWorld ; Date: June 21, 2016

If there's one thing that's certain about the Equity markets, it's that they will

rise and fall. Most of these movements will be minor turbulences, whereas some will

be earthshaking. Undoubtedly, a fair degree of risk aversion ensues .....READ MORE

No need for many innovative products just for the sake of it

Publication: Mint ; Date: June 17, 2016

Suresh Soni, chief executive officer, DHFL Pramerica Asset Managers Pvt Ltd, has

a long road ahead of him. The fund house has just completed its acquisition of Deutsche

Asset Management (India) Pvt. Ltd, a fund house that he headed for .....READ MORE