What are Hybrid Mutual Funds?

A Hybrid Fund is a mutual fund that invests in two or more asset classes. These funds seek to balance asset allocation across asset classes in order to diversify the portfolio and, as a result, the investment risk for investors. Hybrid Funds may also have the potential to generate slightly higher returns than debt funds while being less risky than Equity Funds.

Advantages of Hybrid Mutual Funds

Balances risk with return

Hybrid Fund’s main advantage is that it allows you to strike a balance between risk and return. In comparison to pure Equity Funds, Hybrid Fund provide the stability of assets such as debt. You can take advantage of equity investments by cushioning them with more predictable debt returns. However, because they invest in both equity and debt, these funds are subject to market risk.

Diversification

A Hybrid Fund reduces risk by investing in multiple asset classes. These funds reduce your exposure to risk in any single asset class by storing your money in a variety of assets. As a result, any fluctuations in the equity market can be offset by debt market returns. Hybrid Equity Funds diversify risk further by investing in other markets, such as international equity.

Low volatility

Market volatility affects Equity Funds. In a volatile equity market, Hybrid Funds provide stability through debt and arbitrage investments, lowering overall portfolio volatility.

Convenience

Hybrid Funds invest in multiple asset classes and eliminate the need to invest in each asset class separately, giving you the convenience of multiple asset classes in one fund.

Types of Hybrid Mutual Funds

Investors hesitate to invest in equities in a falling market because they believe the market will continue to fall. Similarly, they anticipate that the market will continue to rise in a bull market. What if there was a product that could buy low and sell high? Balanced Advantage Funds strive to do just that. Balanced Advantage Funds run on dynamic asset allocation models. It is a solution for investors who want to allocate assets to debt and equity in a tax-efficient manner.

What they offer:

Dynamically manage asset allocation | Long-term wealth creation

So what are the advantages?

You should consider Equity Savings Funds if you’re concerned about investing in volatile markets. These funds invest in equity, debt, and other assets, such as equity arbitrage opportunities. The fund's overall equity exposure is partially hedged. This reduces volatility when compared to an Aggressive Hybrid Equity Fund with fully unhedged equity exposure.

What they offer:

So what are the advantages?

- Beats market volatility due to their solution-oriented mix of equity, fixed income and arbitrage

- Offer the potential for capital appreciation, regular income, efficient portfolio

- Debt and arbitrage act as a cushion to minimise downside

- Low correlation of equity, debt and arbitrage generates risk-adjusted returns

- Beats inflation by investing in growth-oriented equity, debt and arbitrage

Hybrid Equity Funds provide you with the power of more than one asset class, the performance of which is mostly unrelated. These funds invest heavily in stock options. A portion may be invested in assets such as global equities, gold, and Real Estate Investment Trusts (REITs), with the remainder in debt securities and money market instruments. These funds have the potential to generate higher returns than debt-oriented Hybrid Funds due to higher exposure to equity and equity-related instruments, but they are riskier.

What they offer:

So what are the advantages?

If you’re seeking equity exposure but are concerned about the risk, then you should go for Arbitrage Funds. These funds profit from the price difference between two markets: the cash market and the futures market. They buy stocks in the cash market and sell them in the futures market. Also invest a large portion of assets in equity and the remainder in debt and money market instruments, on a tactical basis.

What they offer:

So what are the advantages?

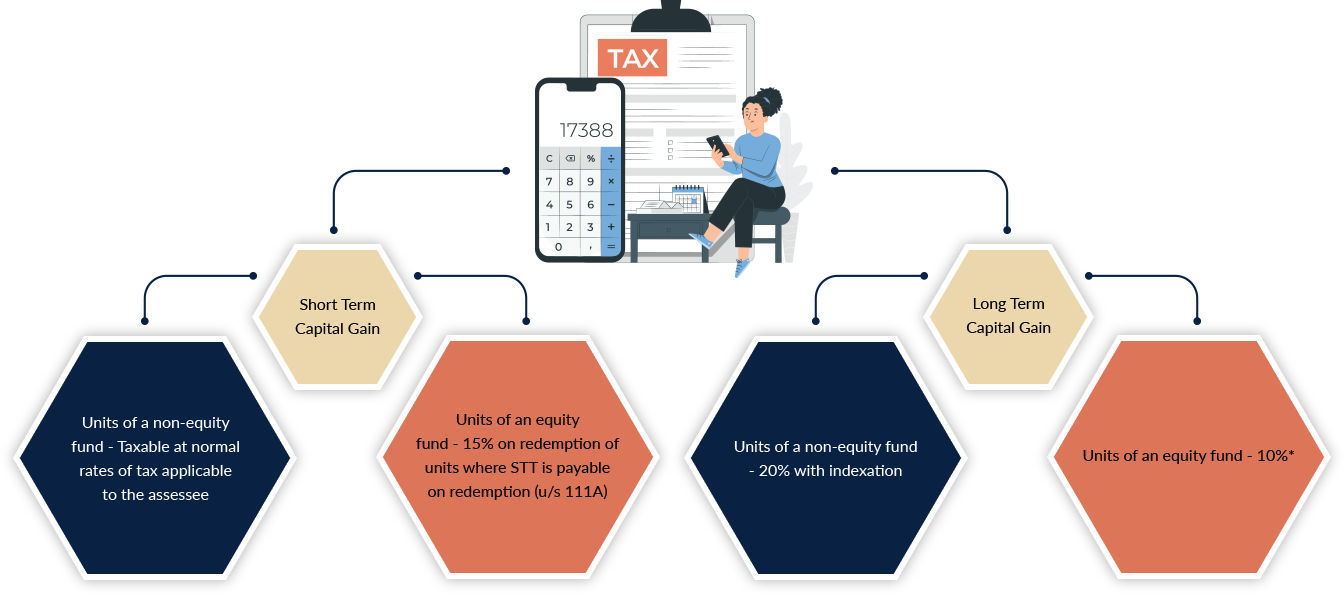

Tax-efficiency of Hybrid Mutual Funds

Units of an equity-oriented fund if held for a period of 12 months or less will be considered as "Short Term Capital Assets" and if held for more than a period of 12 months, will be considered as "Long Term Capital Assets". In respect of all other units of any mutual fund scheme, the same will be treated as "Short Term Capital Assets" if held by unit holders for 36 months or less and the same will be treated as "Long Term Capital Assets" if it is held for more than 36 months.

Tax rates on Capital Gains as per Income Tax Act, 1961. Surcharge & health and education cess are additional, as per the Income Tax Act. *Subsection 2 of section 112A provides that the amount of income tax shall be calculated at the rate of 10 per cent on long term capital gains exceeding one lakh rupees in a financial year.

In Nutshell

Hybrid Funds are typically intended for long-term investments of up to five years. The longer time horizon ensures stability and allows the investment to produce healthy long-term returns. The risk in Hybrid Funds is typically derived from the equity component. That’s why you should always consider your risk profile when determining the proportion of equity. Risk in a debt-oriented Hybrid Fund is defined by whether we seek capital gains or interest income.

Risk diversification is one of the most important aspects of prudent investment. Hybrid Funds, by definition, allow you to pursue diversification across asset classes while avoiding concentration in a single class or industry. As a result, Hybrid Funds have become a popular investment option, particularly for those with a low risk tolerance.